Introduction

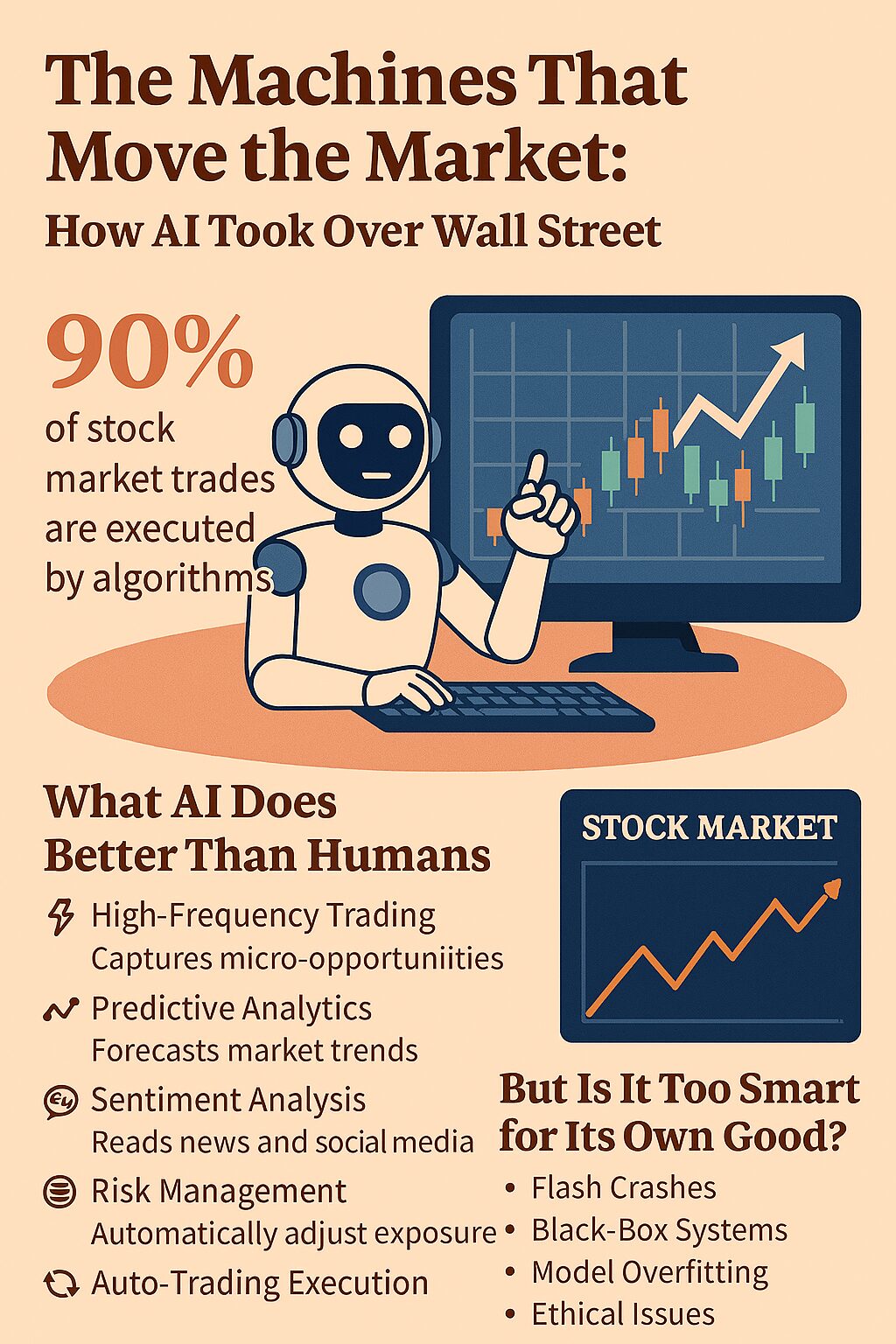

In 2025, the stock market is no longer driven by human intuition alone. With 90% of trades now executed by algorithms, artificial intelligence has become the invisible hand behind global finance. From high-frequency trading to predictive analytics, AI is transforming how markets move, how decisions are made, and who profits.

This article explores the rise of AI in trading, its benefits, risks, and what it means for investors and regulators.

🤖 What Is AI Stock Trading?

AI stock trading refers to the use of machine learning, natural language processing, and automated algorithms to analyze market data and execute trades. These systems can:

- Detect patterns in real-time

- Forecast price movements

- Execute trades in milliseconds

- Adapt to changing market conditions

- Minimize human error and emotional bias

Platforms like Trade Ideas, TrendSpider, and Tickeron are leading the charge with AI bots that outperform traditional strategies.

📊 How AI Controls 90% of Trades

| AI Functionality | Impact on Trading |

|---|---|

| ⚡ High-Frequency Execution | Trades executed in microseconds for arbitrage and momentum gains |

| 📈 Predictive Analytics | Forecasts market trends using historical and real-time data |

| 🧠 Sentiment Analysis | Interprets news, social media, and earnings reports |

| 🧮 Risk Management Algorithms | Adjusts portfolios based on volatility and exposure |

| 🔄 Auto-Trading Bots | Executes buy/sell orders without human intervention |

According to recent reports, algorithmic trading accounts for up to 90% of U.S. equity market volume, with similar trends in Europe and Asia.

💡 Benefits of AI in the Stock Market

| Advantage | Description |

|---|---|

| ⏱️ Speed & Efficiency | Executes trades faster than any human trader |

| 📉 Reduced Costs | Minimizes transaction fees and overhead |

| 📊 Data-Driven Decisions | Uses vast datasets for informed trading |

| 🧮 Error Reduction | Eliminates emotional and cognitive biases |

| 🌍 Global Scalability | Operates across markets and time zones simultaneously |

AI enables traders to respond to market shifts with precision and speed that were previously unimaginable.

⚠️ Risks and Ethical Concerns

Despite its power, AI trading raises serious concerns:

- 🔍 Market Volatility: Algorithms can amplify flash crashes and sudden swings

- ⚖️ Lack of Transparency: Many AI models operate as “black boxes”

- 🧠 Overfitting: AI may misinterpret short-term noise as long-term trends

- 🔐 Data Privacy: Sensitive financial data must be protected

- 🧑⚖️ Regulatory Oversight: Who is accountable when AI makes a bad trade?

Regulators are now exploring frameworks to monitor and audit AI-driven trading systems.

🌍 Global Adoption and Trends

- Wall Street firms use AI for portfolio optimization and risk modeling

- Retail investors increasingly rely on AI-powered platforms for day trading

- Regulators use AI to detect fraud and unusual trading patterns

- Quantum computing is being explored to enhance AI trading models

AI is not just a tool—it’s becoming the infrastructure of modern finance.

🔍 SEO Tips for Financial Content Creators

✅ High-Impact Keywords

- “AI in stock trading 2025”

- “algorithmic trading volume”

- “automated trading bots”

- “machine learning in finance”

✅ Metadata Optimization

- Meta Title: “AI and the Stock Market: Algorithms Control 90% of Trades”

- Meta Description: “Explore how artificial intelligence dominates stock trading, with 90% of trades now executed by algorithms in 2025.”

✅ Structured Formatting

- Use headings, tables, and bullet points for readability

- Include alt text for visuals (e.g., “AI dashboard analyzing stock market trends”)

Conclusion

AI has revolutionized the stock market, turning trading into a data-driven, algorithmic battlefield. With 90% of trades now controlled by machines, the future of finance is fast, automated, and increasingly complex.

But as we embrace the power of AI, we must also confront its risks—ensuring that speed doesn’t come at the cost of stability, and that innovation is matched by accountability.